New Stamp Duty Rules from April 2025 – How Will They Affect You?

Stamp duty might not be the most exciting topic, but it can have a significant impact on your property investments—whether you’re a first-time buyer, an investor, or a developer. From April 1, 2025, new Stamp Duty rules came into effect in England, potentially increasing costs for many buyers. Often, stamp duty and other “hidden” taxes are overlooked when purchasing a home or investment property, yet they can significantly affect your budget. The changes may impact not only your initial purchase price but also your ability to carry out renovations or extensions. Planning ahead can help you navigate these changes and avoid unexpected costs when buying in 2025. Stay ahead in the property market this spring with our latest updates.

What is Stamp Duty?

- Stamp Duty Land Tax (SDLT) is a tax levied when purchasing property or land in England and Northern Ireland.

- Land Transaction Tax (LTT) is a similar tax applied to property transactions in Wales.

For Wales, the Land Transaction Tax (LTT) rates remain under review, with no proposed changes at this time.

How Much Stamp Duty Will I Owe as a First-Time Buyer?

Before April 1, 2025, first-time buyers in England and Northern Ireland paid no stamp duty on properties valued up to £425,000. However, from April 1, 2025, the exemption threshold is being reduced to £300,000. Properties priced between £300,001 and £500,000 will now incur a 5% stamp duty rate on the portion above £300,000.

Example: If you purchase a home for £350,000, you will now pay 5% stamp duty on the £50,000 above the £300,000 threshold, totaling £2,500.

For home movers, properties costing up to £250,000 were previously exempt from stamp duty. However, from April 1, 2025, stamp duty will apply as follows:

- 0% on properties up to £125,000

- 2% on the portion between £125,001 and £250,000

- 5% on the portion from £250,001 to £925,000

What About Wales? Unlike England, Wales does not offer specific tax reliefs for first-time buyers. However, many first-time buyer homes fall within the zero-rate threshold of £225,000 under Land Transaction Tax (LTT).

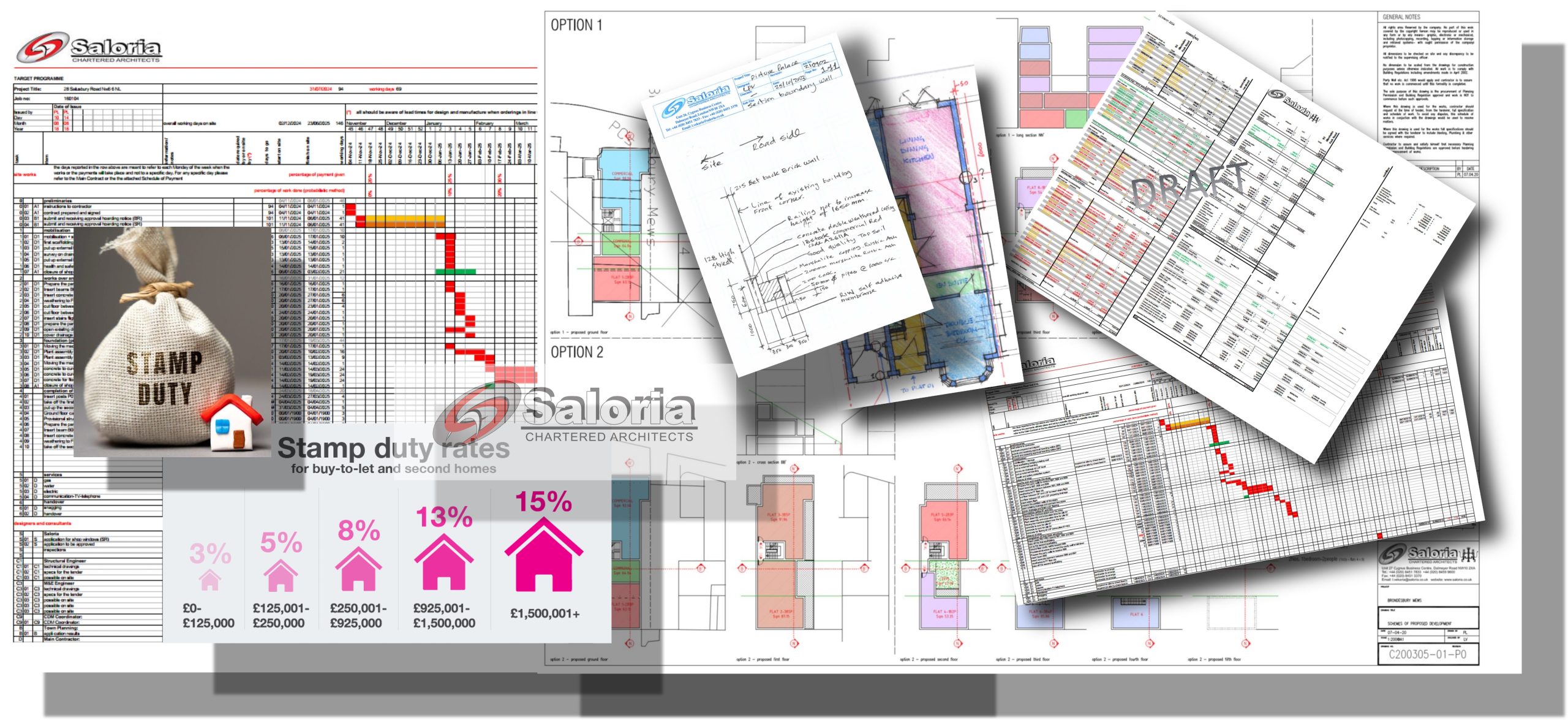

How Will These Changes Affect Investors and Multiple Property Owners?

Previously, those owning more than one property paid 5% stamp duty on properties priced between £0 and £250,000. From April 1, 2025, the 5% rate will only apply to the first £125,000 of the property value. The new structure introduces:

- 5% on the first £125,000 (£6,250)

- 7% on amounts between £125,001 and £250,000 (£8,750)

- 10% on amounts exceeding £250,000

For investors in Wales, LTT is still under review. Currently, multiple property owners pay:

- 4% on the first £180,000

- 7.5% on £180,001 to £250,000

- 9% on £250,001 to £400,000

- 11.5% on £400,001 to £750,000

- 14% on £750,001 to £1,500,000

- 16% on amounts above £1,500,000

Plan Your Property Purchase Wisely

If you’re planning to buy a property from April 2025 onward, it’s important to factor in these tax changes when budgeting. A smart approach is to explore different purchase strategies. In some cases, buying a smaller property and allocating funds for extensions or renovations might be more beneficial than purchasing a larger home with limited resources for improvements.

At Saloria, we provide expert guidance on property purchases and cost-effective renovation strategies. Get started today by booking a free property valuation for tailored advice that extends beyond a simple home value estimate. We can help you compare costs, bring the team together to help you assess the tax implications, and strategize your next move in the property market. Click here to contact us.